Sponsored by the Internal Revenue Service (IRS), our free tax preparation programs provides high-quality assistance to Pickens County individuals and families, helping our hard-working neighbors get every dollar they deserve.

There are two easy ways to file your taxes for free:

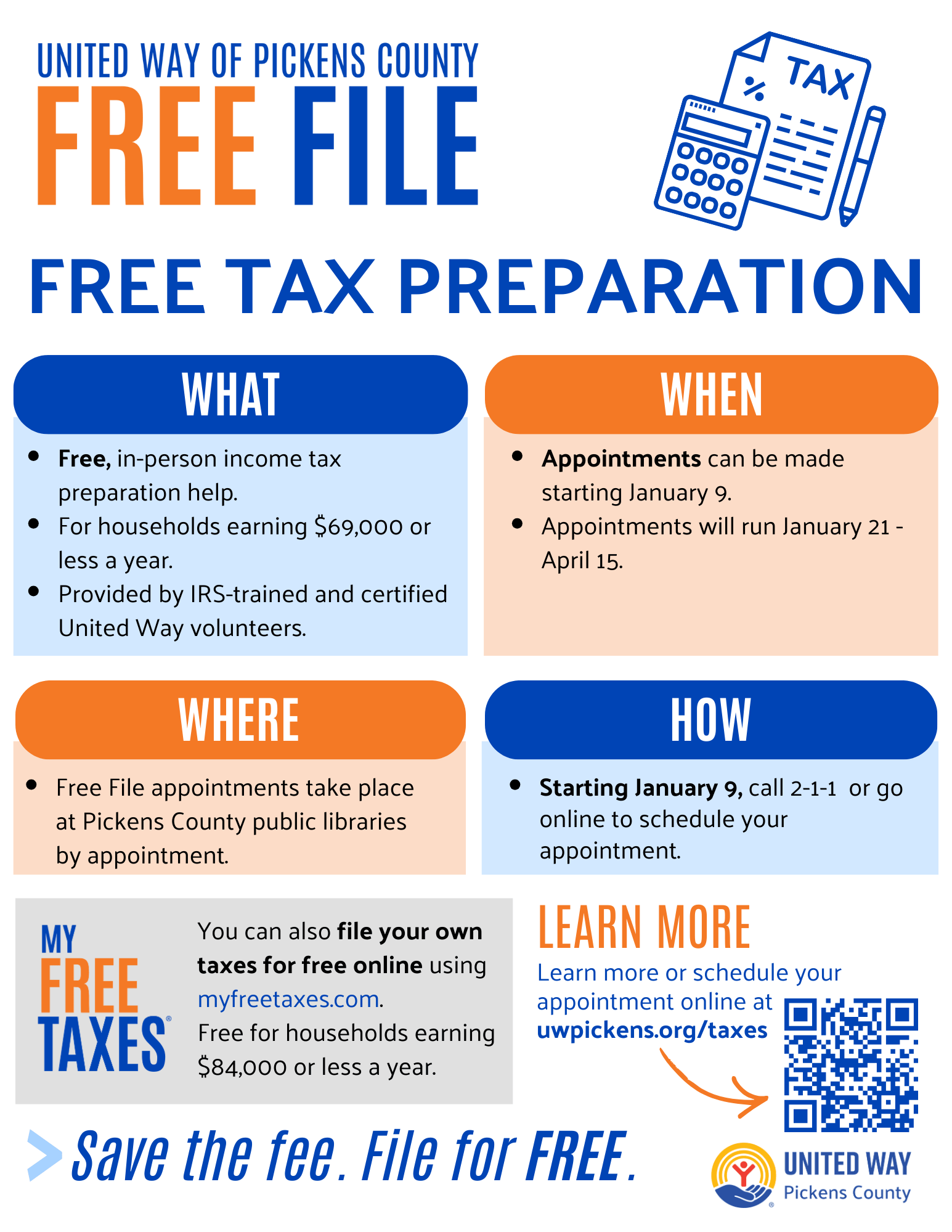

GET IN-PERSON HELP WITH A FREE FILE APPOINTMENT

Appointments required. Schedule your appointment today:

Online: https://www.eznetscheduler.com/Calendar.aspx?ci=10514

By phone: Dial 211 (or 1-866-892-9211)

Free in-person tax preparation assistance is available to Pickens County individuals and families with an annual household income of $69,000 or less. Our team of IRS trained and certified volunteers work with you to find all eligible deductions and tax credits.

Clients arrive to their appointment, complete intake forms and provide necessary documentation to the volunteer tax preparer. Once the return is complete, another certified volunteer will review the return for accuracy then the entire return will be reviewed with the client.

With direct deposit, refunds typically arrive within 7–21 days when filed electronically.

What to bring to your appointment

Click here to see a list of everything you need to bring with you to your appointment.

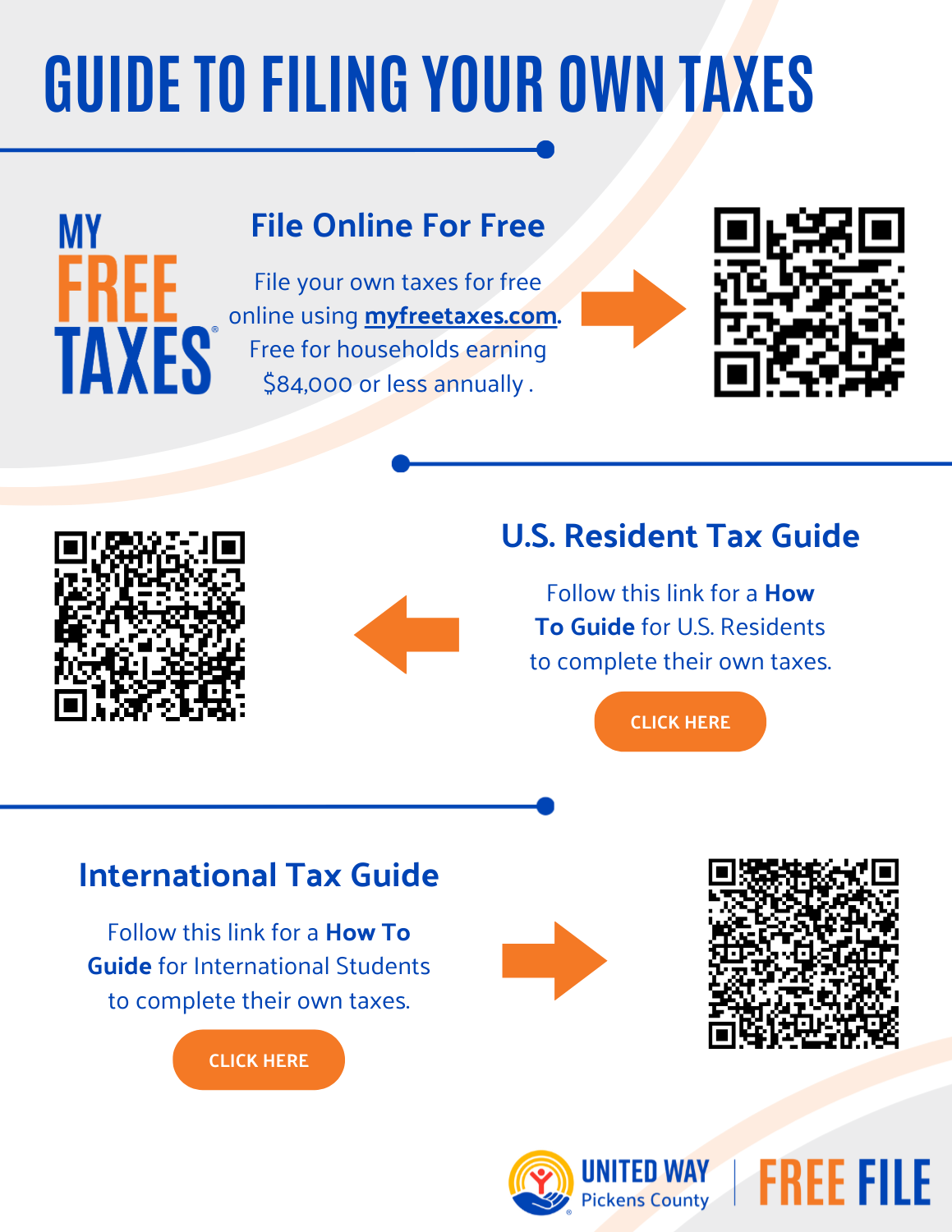

DO-IT-YOURSELF WITH MyFreeTaxes.com

Guide to filing your own taxes

Need help? Chose the guide that is right for you!

How-To Guide for US Residents to complete your own taxes.

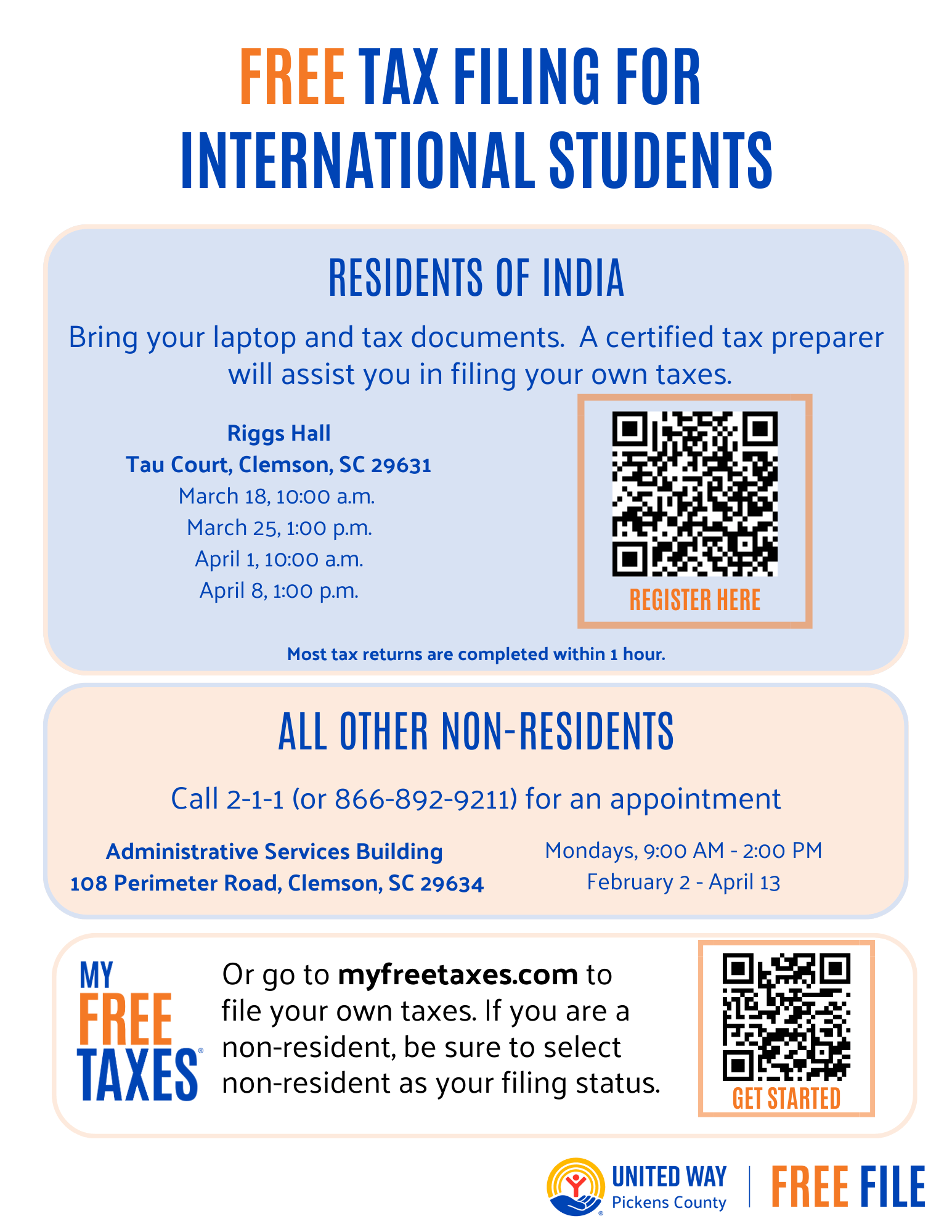

How-To Guide for International Students to complete your own taxes.

BE A HERO: VOLUNTEER

Free File Volunteers are essential to providing this free tax filing service! Click here to learn more about this vital opportunity.

RESOURCES

Download PDF versions of resources to share with others.

.png)