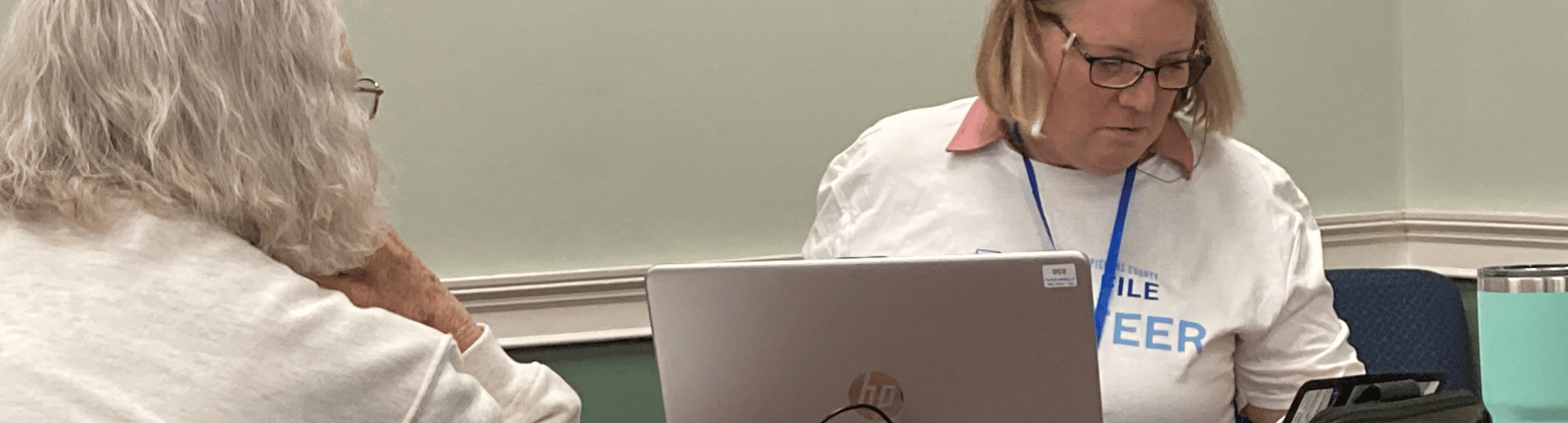

Free File could not happen without an amazing team of volunteers. In a typical tax season, about 60 community volunteers complete IRS certification training and prepare over 2,200 tax returns for individuals and families with an average income of approximately $24,000.

With locations at all Pickens County libraries, Clemson University, and local businesses across the community, you can volunteer where it is most convenient for you. There are volunteer opportunities available during weekday, evening, and weekend hours, and there is no minimum time requirement to volunteer. You can commit as much or as little time as you are available. No prior experience is necessary, and training is free!

Explore the various Free File volunteer positions by opening each item below, or visit our Frequently Asked Questions page to learn more.

Free File Intake Coordinators often have the first interaction with the taxpayer. Intake Coordinators are helpful, kind, and provide basic direction. They greet taxpayers as they arrive and ensure that the taxpayer has the necessary documents to complete their return, ask them to sign in, and show them where to go next.

Requirements:

Intake Coordinators must complete the Volunteer Standards of Conduct and the Intake Interview & Quality Review Training. All volunteers must also submit a signed volunteer agreement.

Free File Tax Preparers provide a valuable service to the taxpayer. Tax Preparers can provide basic education and assistance to the taxpayer. Volunteer Tax Preparers utilize the electronic tax software to prepare returns for eligible resident taxpayers.

Requirements:

All Pickens County Free File Volunteer Tax Preparers must certify at the advanced level. Volunteer Tax Preparers must complete the Volunteer Standards of Conduct, the Intake Interview & Quality Review Training, and the Advanced Exam Certifications. When certifying in Advanced, Basic Certification, is NOT necessary. All volunteers must also submit a signed volunteer agreement.

Volunteer Tax Preparers for Foreign Student Taxes provide a valuable service to international students who don't often have access to free tax preparation. Tax Preparers utilize the electronic tax software to prepare returns for eligible non-resident taxpayers.

Requirements:

Tax Preparers for Foreign Student Taxes must complete the Volunteer Standards of Conduct, the Intake Interview & Quality Review Training, and the Foreign Student Tax Exam Certifications. All volunteers must also submit a signed volunteer agreement.

Free File Site Coordinators manage the tax site. Site Coordinators quality review all tax returns and assist other volunteers as needed. Site Coordinators maintain schedules for all volunteers to encourage coverage, ensure supplies and equipment needed are at the site, and resolve any issues that arise. The Site Coordinator is also responsible for quality reviewing all prepared taxes, printing, and reviewing the documents with the taxpayer. Site Coordinators are responsible for making sure all prepared taxes are filed and that rejected returns are corrected and refiled in a timely manner.

Requirements:

Site Coordinators have four certification requirements (Step 2) Volunteer Standards of Conduct, the Intake Interview & Quality Review Training, the Advanced Exam, and the Site Coordinator Certification. Site Coordinators are also required to attend a separate Site Coordinator Training. All volunteers must also submit a signed volunteer agreement.

Volunteer Interpreters provide a valuable service to tax payers who have limited English speaking abilities or use sign language to communicate. Interpreters are needed for ASL, Spanish and other languages to assist our resident, non-resident and refugee taxpayers.

Requirements:

All volunteers must complete the Volunteer Standards of Conduct and the Intake Interview & Quality Review Training. All volunteers must also submit a signed volunteer agreement.

BECOME A FREE FILE VOLUNTEER

Ready to join the team? Follow the steps below to start your path towards making a difference in the lives of your Pickens County neighbors!

STEP 1: APPLY

Click the button below to complete the Free File Volunteer Application.

STEP 2: GET TRAINED

Learn everything you need to know at one of our training sessions.

STEP 3: GET CERTIFIED

When you are ready, start the certification process.

STEP 4: VOLUNTEER

Once you are certified, you are ready to volunteer!

QUESTIONS?

For more information, visit our Frequently Asked Questions page.